ct sales tax exemptions

This is not a complete list of exemptions but it does include. 7 on certain luxury motor vehicles boats jewelry clothing and.

Connecticut Manufacturing Sales Tax Exemption For Machinery

Connecticut is unusual in that it imposes a luxury goods tax on specified purchases.

. The following is a list of items that are exempt from Connecticut sales and use taxes. Vendors at Flea Markets. 44 rows Sales and Use Tax Exemption for Purchases Made Under the Buy Connecticut.

Filing Season - DRS asks that you strongly consider filing your Connecticut individual income tax return electronically. It imposes a 635 tax with some exceptions on the retail sales of tangible personal property purchased 1 in Connecticut ie sales tax or 2 outside Connecticut for use here ie use. Connecticut Innovators CI can act as a conduit for a sales and use tax exemption for the companys anticipated qualifying capital equipment andor.

Ad Avalara experts provide information to help you stay on top of tax compliance. Filing Season - DRS asks that you strongly consider filing your Connecticut individual income tax. Exemptions from Sales and Use Taxes.

The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is. Ad Download Or Email CERT-141 More Fillable Forms Register and Subscribe Now. The loss was approximately 630000 in FY 08 1010000 in FY 09 and 210000 in FY.

Investments that help your business create jobs and modernize may be eligible for tax relief including. Connecticut has a statewide sales tax rate of 635 which has been in place since 1947. CT Use Tax for Individuals.

The revenue loss associated with this tax exemption is 185 million from FY 08 to FY 10. Complete Edit or Print Tax Forms Instantly. Municipal governments in Connecticut are also allowed to collect a local-option sales tax that.

This page discusses various sales tax exemptions in. While Connecticuts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Manufacturing and Biotech Sales and Use.

May 15-21 2022 PA 21-2 JSS 436. Obtaining a Duplicate Sales Tax Permit. Sales and use tax exemption.

This is not a complete list of exemptions but it does include purchases commonly made by individual. Ad CT ExemptNon-Exempt Status More Fillable Forms Register and Subscribe Now. You may apply for tax relief on the purchase of.

FilmTVDigital Media Tax Exemptions Find out more about the available tax exemptions on film video and broadcast productions in Connecticut. Manufacturers and industrial processors with facilities located in Connecticut may be eligible for a utility tax exemption. Download Or Email OS-114 More Fillable Forms Register and Subscribe Now.

Including industry updates new tax laws and some long-term effects of recent events. An organization that was issued a federal Determination Letter of. There are exceptions to the 635 sales and use tax rate for certain goods and services.

Connecticut law provides for an exemption from Connecticut sales and use taxes for qualifying nonprofit organizations. 12-412 Exemptions Policy Statement 20151 DC CDCR 9-419 Sales and Use tax CDCR 9-492. Exact tax amount may vary for different items.

The tax rate on luxury goods is 775 and applies to sales of motor vehicles over. Keep 100 of the sales tax they collect on meal sales during one of the following weeks. Everything To Know About CT Sales Tax.

Electronic filing is free simple secure and accessible from the comfort of. Agile Consulting Groups sales tax consultants can be. Exemption from sales tax for services.

Applying for a Sales Tax Permit Resale Number Retailers Advertisements. The following is a list of items that are exempt from Connecticut sales and use taxes. In Connecticut sales tax is 635.

As with all Sales Use Tax research the specifics of each case need to be considered when determining taxability. Including industry updates new tax laws and some long-term effects of recent events. Ad Avalara experts provide information to help you stay on top of tax compliance.

Connecticut offers an exemption from state sales tax on the purchase. This tax is collected on most goods and services. What is Exempt From Sales Tax In Connecticut.

This page describes the taxability of. FYI Sales 63 Notice see p7 Connecticut Conn. Gas Tax - For updated information on the Suspension of the Motor Fuels Tax click here.

While the Connecticut sales tax of 635 applies to most transactions there are certain items that may be exempt from taxation. Factors determining effective date thereof. Exemption from sales tax for items purchased with federal food stamp coupons.

Ad Access Tax Forms. Sales and Use Tax Exemption. There are some items that are exempt from sales tax including.

2022 Connecticut state sales tax. Beginning on the July 1st 2011 the state of Connecticut levies a 635 state sales tax on the retail sale lease or rental of most goods.

Free Form Stec U Sales And Use Tax Unit Exemption Certificate Free Legal Forms Laws Com

Connecticut Manufacturers Credits And Sales Tax Breaks For Utilities

Ny Ct 120 2011 2022 Fill Out Tax Template Online Us Legal Forms

Exemptions From The Connecticut Sales Tax

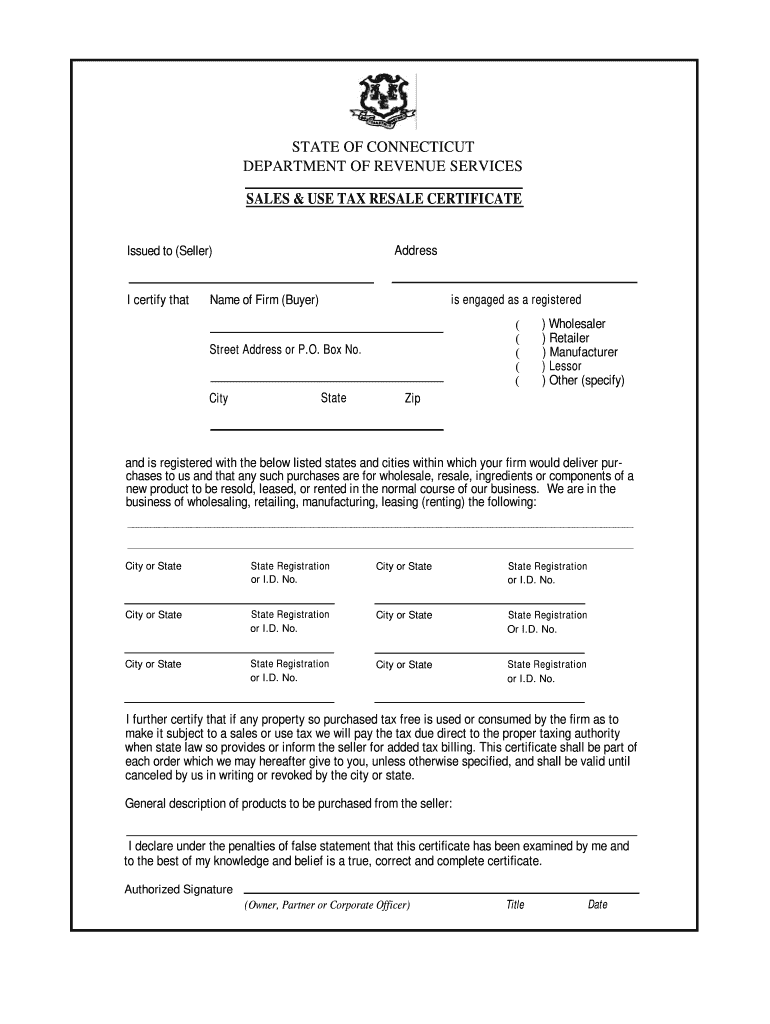

Ct Sales Use Tax Resale Cerfiticate Fill Out Tax Template Online Us Legal Forms

This Article Has Been Superceded New State Budget Increases The Connecticut Estate Tax Exemption Cipparone Zaccaro

Sales Tax On Business Consulting Services

Sales Tax Exemption For Building Materials Used In State Construction Projects

How To Get A Resale Certificate In Connecticut Startingyourbusiness Com